Tax Forms: Which form will I receive?

April 9, 2021

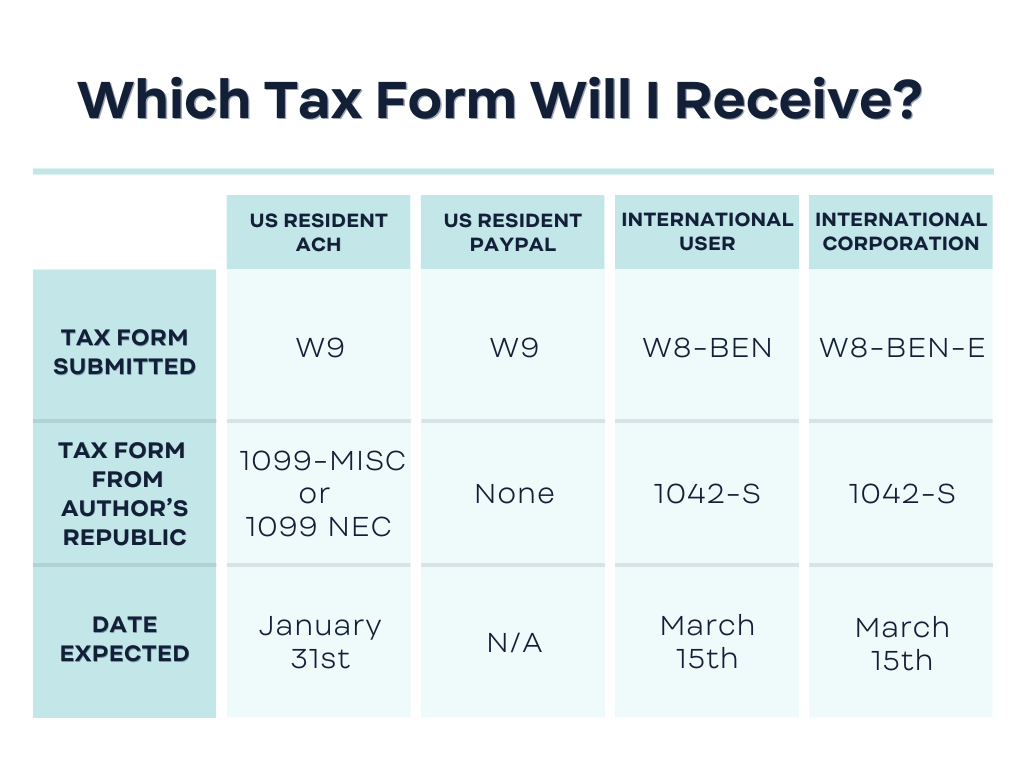

If you’ve earned at least $10 in royalties in the prior tax year, when tax season rolls around you can expect to receive a tax form from us.

Depending on which tax form you submitted when registering with Author’s Republic, you’ll either receive Form 1099-MISC, 1099-NEC or Form 1042-S.

Form 1099-MISC and 1099-NEC are only issued to account users that have selected Direct Deposit (ACH) as the payment method. If you have selected PayPal, PayPal will issue a 1099-K.

Please keep in mind that we are not qualified to give tax advice. If you need additional guidance we recommend reaching out to a tax professional.

Which Tax Form Will I Receive?

Which tax form did I submit?

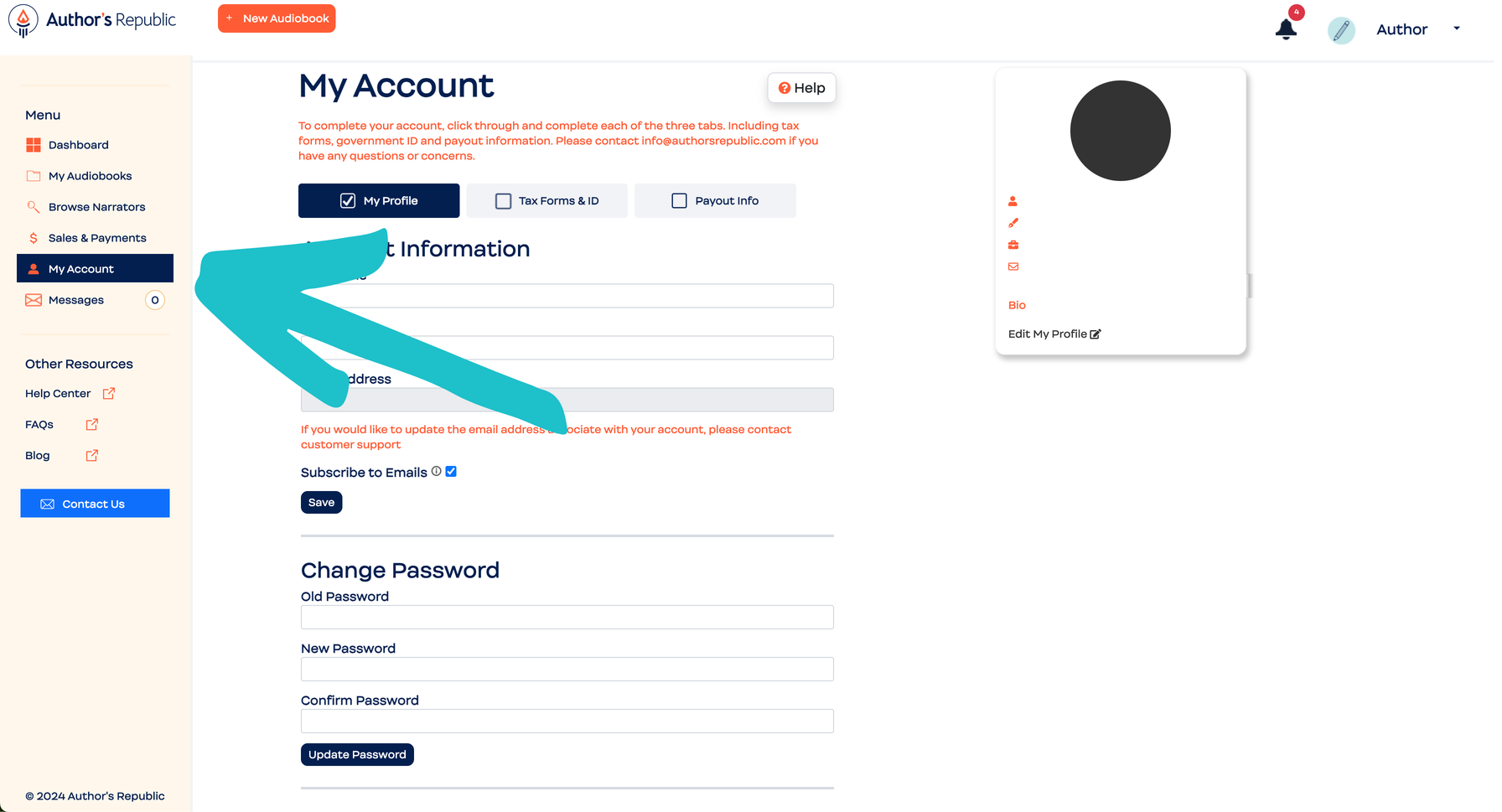

If you’re not sure which tax form you originally submitted to us you can check by logging into your Author’s Republic account.

Step 1:

Log in to your account and select “My Account” from the navigation menu on the left.

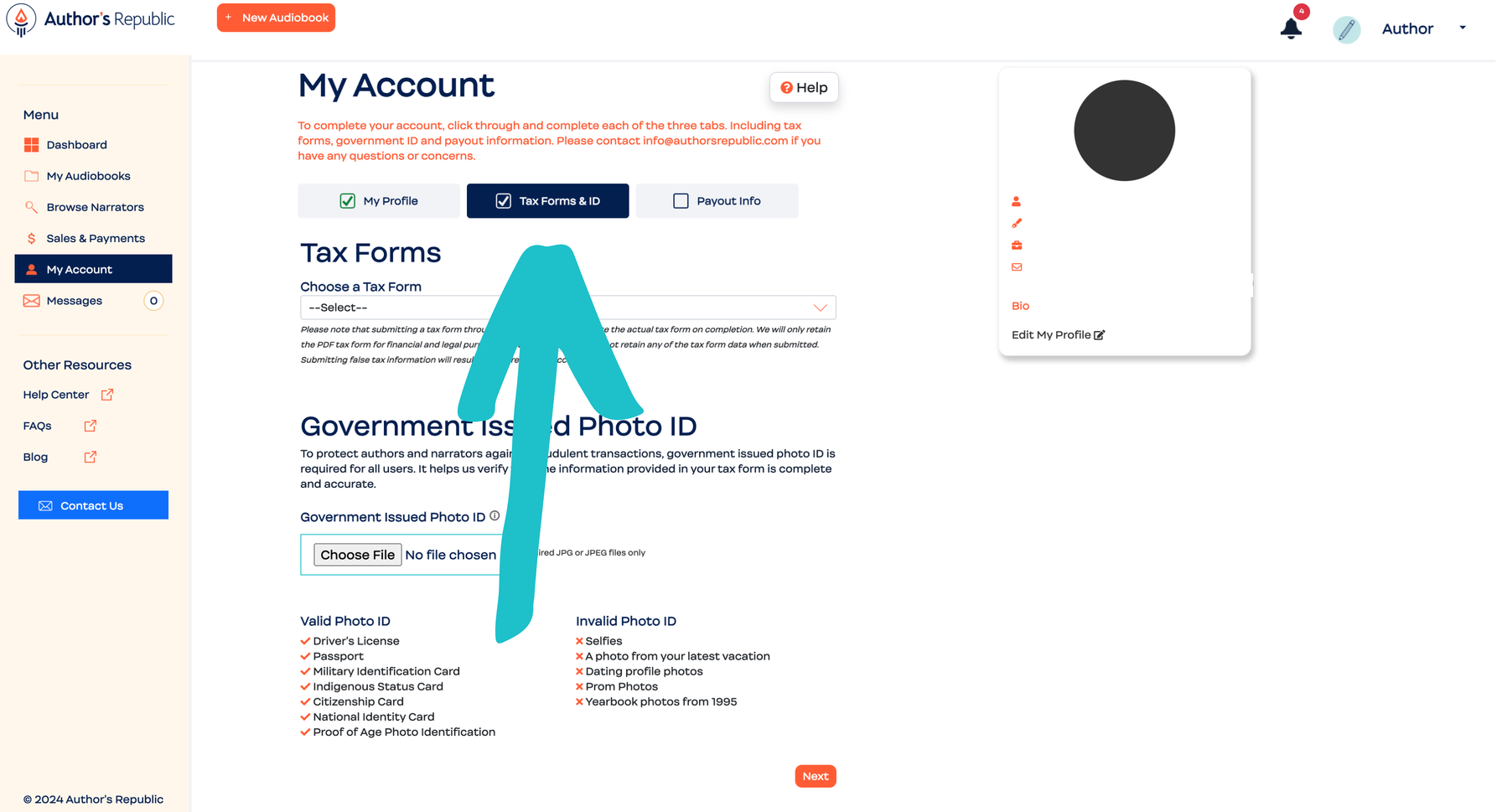

Step 2:

Select the “Tax Forms & ID” tab

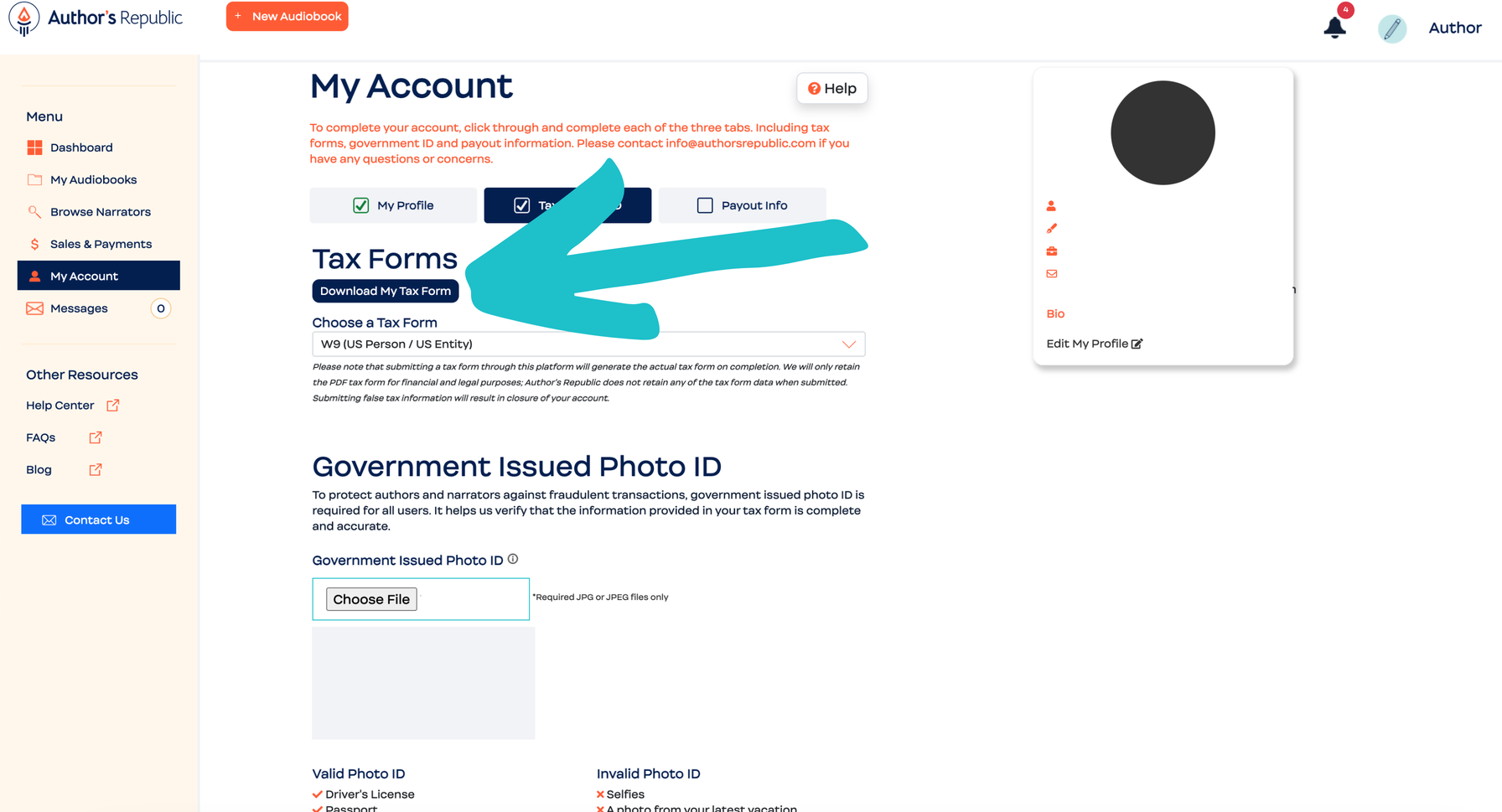

Step 3:

Select “Download My Tax Form”

Tax Form 1099

What is a Form 1099?

A Form 1099-MISC is a record that an entity or person (other than your employer) paid you US-sourced money. A Form 1099-NEC is a record that an entity or person was paid as an independent contractor.

When will I get my form?

If applicable, you will receive Form 1099-MIS or 1099-NEC by January 31st each year for prior tax year royalties earned.

Why didn’t I receive a Form 1099?

Either you did not have over $10 in royalty earnings in the prior tax year, you received a 1099-K from PayPal, you are a non-US person, or you submitted incorrect tax information.

Why don’t the royalties on my sales dashboard match my tax form?

The amount displayed on your tax form is your gross income for the tax year. This is the total revenue received over the course of the tax year before any deductions for transaction fees are made. The sales dashboard reflects royalties earned within the sales range selected. The amount differs as royalties are typically paid the following month they are earned.

Example: Royalties earned for the month of December would be paid at the end of the following January.

Note: You may be able to claim a tax deduction for the transaction fees when you prepare your tax return. Please speak with your tax advisor/accountant about this.

Tax Form 1042-S

What is a Form 1042-S?

Form 1042-S is used to report taxes withheld on US-sourced income of non-US individuals or entities.

When will I get my form?

You will receive Form 1042-S by March 15th each year for prior year royalties earned and taxes withheld.

Why didn’t I receive a Form 1042-S?

You may not have been issued a Form 1042-S because you did not submit your tax information, or you submitted incorrect tax information.

When do I get my money back?

Based on your personal tax rate and other earnings, as well as the tax laws in your home country, you may receive a refund on the taxes withheld after you file your taxes in your home country.

Note: It is best to speak to your tax advisor/accountant for more information.

Why don’t the royalties on my sales dashboard match my tax form?

The amount displayed on your tax form is your gross income for the tax year. This is the total revenue received over the course of the tax year before any deductions for transaction fees are made. The sales dashboard reflects royalties earned within the sales range selected. The amount differs as royalties are typically paid the following month they are earned.

Example: Royalties earned for the month of December would be paid at the end of the following January.

Note: You may be able to claim a tax deduction for the transaction fees when you prepare your tax return. Please speak with your tax advisor/accountant about this.

If you have any questions about tax forms, please contact customer service at [email protected].

*The information on this page is not intended as tax advice. Please reach out to your tax advisor/accountant for any tax guidance and more information on these forms.